Commercial insurance is a highly competitive business segment with razor-thin margins, stuck in a legacy operating model, relying on layers of operational teams or BPOs. This high-intensity manual work has disastrous compounding effects, both for their loss ratio and their operating performances, with underwriters and assistants spend approximately half of their time on administrative work rather than focusing on risk evaluation and a large number of opportunities being lost to faster competitors.

Slow turnaround times: the slowness of manual handling prevents commercial insurers from sending quotes back to brokers quickly, thus potentially missing out on new business

High costs: adding layers of manual work creates corresponding layers of costs, piling up operational expenses for commercial insurers and degrading their combined ratio

Minimal data: due to the limits of slow, expensive parsing through the mandatory data provided, supplemental data sources are excluded, limiting the effectiveness of evaluations

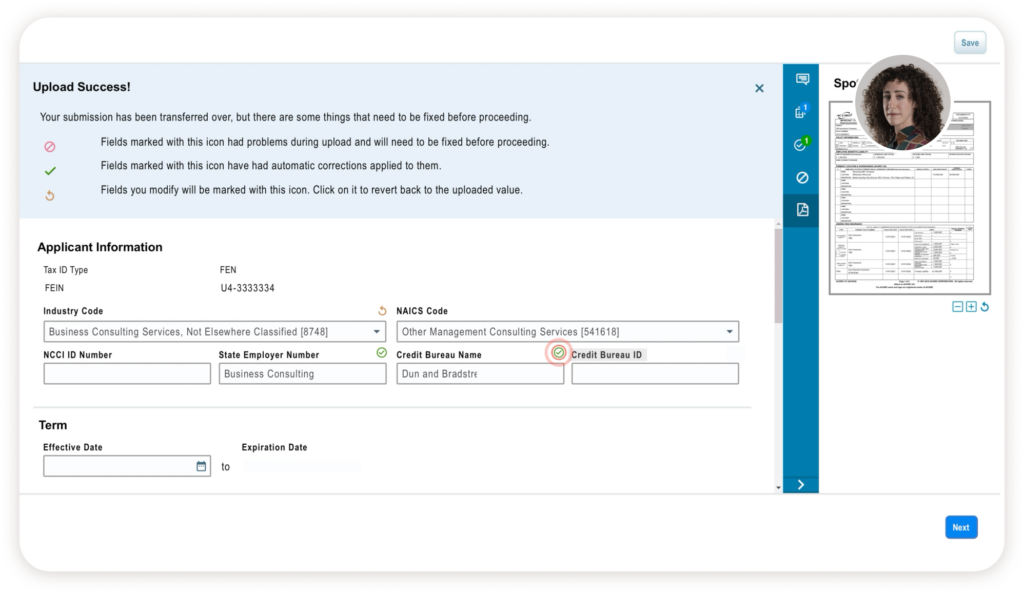

Automatically lifting inbound underwriting documentation from emails and attachments (ACORD forms, SOVs, loss run reports, etc.)

Classifying documents into types

Extracting key datapoints from documents

Cross-referencing external data enrichment sources for additional underwriting-related data

Validating application for completeness via custom business rules

Packaging final structured data in a consolidated way, including integrating with systems such as Bold Penguin, Duck Creek, Pega, and Guidewire

reduction of manual work for the underwriter team

of incoming submissions processed straight-through, no need for supervision

faster turnaround time

Ilana is an AI Insurance Underwriter who streamlines new business application submission processing for insurers.